Air Lease Corporation Reports Third Quarter 2025 Net Profit of $135.4 million or $1.21 per Diluted Share

- Joe Breitfeller

- Nov 4, 2025

- 3 min read

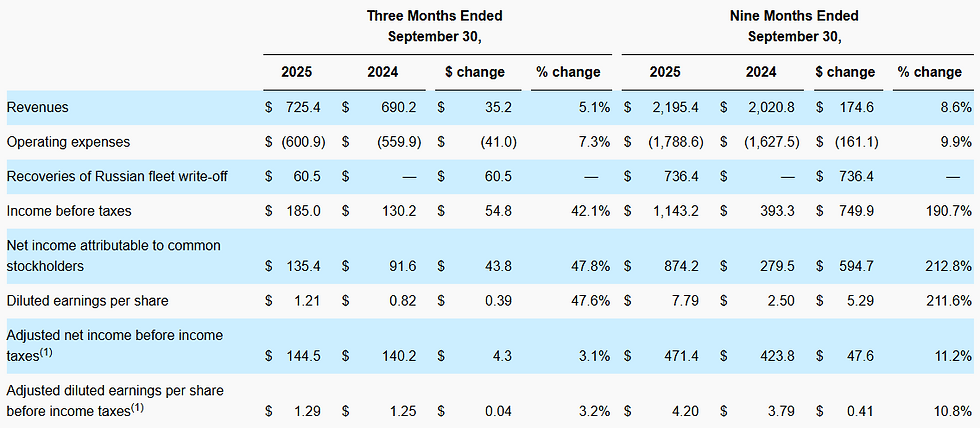

Air Lease Corporation has reported a third quarter 2025 net profit of $135.4 million or $1.21 per diluted share on a 35.2 percent year-over-year increase in revenue to $725.4 million.

On Monday (November 3, 2025), Air Lease Corporation (AL) reported their third quarter financial results for the period ending September 30, 2025. The company reported a third quarter 2025 net profit of $135.4 million or $1.21 per diluted share on a 35.2 percent year-over-year increase in revenue to $725.4 million. During the period, AL entered into an agreement and plan of merger to be acquired by Sumisho Air Lease Corporation Designated Activity Company. The transaction is currently expected to close in the first half of 2026 and is subject to customary closing conditions, including approval by our Class A common stockholders and receipt of certain regulatory approvals.

During the third quarter, AL took delivery of 13 aircraft from their orderbook, representing $685.0 million in aircraft investments, and ended the period with 503 aircraft in our owned fleet and over $33 billion in total assets. The company also recognized a net benefit of approximately $60 million from the settlement of insurance claims related to their former Russian fleet for the three months ended September 30, 2025. As of November 3, 2025, Air Lease Corporation has recovered 104 percent of their Russian Fleet write-off that was recorded in March of 2022 at the onset of the Russian-Ukraine War.

Air Lease also sold five aircraft during the third quarter for $220 million in sales proceeds, and currently has approximately $1.6 billion of aircraft in their sales pipeline, including approximately $342 million in flight equipment held for sale as of September 30, 2025, and approximately $1.3 billion of aircraft subject to letters of intent. The company has placed 100 percent and 96 percent of their expected orderbook on long-term leases for aircraft delivering through the end of 2026 and 2027, respectively, and has placed approximately 64 percent of our entire orderbook delivering through 2031.

The aircraft lessor ended the quarter with $29.3 billion in committed minimum future rental payments consisting of $19.6 billion in contracted minimum rental payments on the aircraft in our existing fleet, and $9.7 billion in minimum future rental payments related to aircraft which will deliver during the last three months of 2025 through 2031.

As of September 30, 2025, the net book value of AL’s fleet increased to $29.5 billion, compared to $28.2 billion as of December 31, 2024. At the end of the period, the company owned 503 aircraft in our aircraft, including 365 narrowbody aircraft and 138 widebody aircraft, and managed 50 aircraft. The weighted average fleet age and weighted average remaining lease term of flight equipment subject to operating lease as of September 30, 2025 was 4.9 years and 7.2 years, respectively.

Based in Los Angeles, California, Air Lease Corporation (NYSE: AL) is a leading global aircraft leasing company. The ALC team is principally involved in the purchase of commercial aircraft and leasing them to airlines worldwide with customized leasing and financing solutions. At June 30, 2025, the company had a globally diversified customer base of 108 airlines across 55 countries.

Source: Air Lease Corporation