Ryanair Reports Full Year Net Profit of €1.43 Billion or €1.16 per Share

- Joe Breitfeller

- May 22, 2023

- 3 min read

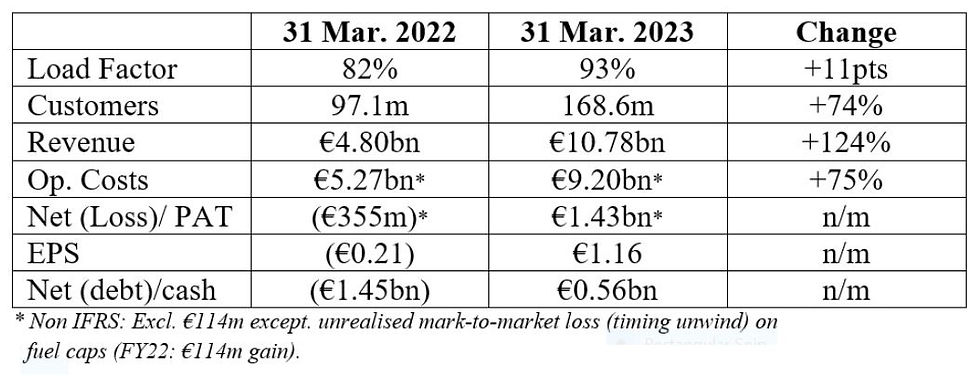

Ryanair has today reported a full year net profit of €1.43 billion or €1.16 per share on a year-over-year increase in revenue of 124 percent to €10.78 billion. At March 31, 2023, the carrier had €4.7 billion in gross cash and €560 million in net cash.

On Monday (May 22, 2023), Ryanair reported their full year financial results for the fiscal year ending March 31, 2023. The carrier reported a full year net profit of €1.43 billion or €1.16 per share on a year-over-year increase in revenue of 124 percent to €10.78 billion. At March 31, 2023, Ryanair had €4.7 billion in gross cash, after an €850 million bond repayment in March, and net cash of €560 million, despite over €1.9 billion in FY 2022/23 CAPEX. During the year, the airline took delivery of 98 Boeing 737-8200 MAX ‘Gamechangers’ and ended the financial year with a fleet of 537 aircraft. Ryanair has also ordered up to 300 Boeing 737-10 MAX airplanes, as the company plans to grow traffic to 300 million guests annually by FY 2034.

In Monday’s announcement, Ryanair Group’s CEO, Michael O’Leary, said in part,

“…Ryanair’s market share has grown significantly in most EU markets as we operated 116% of our pre-Covid capacity in FY23. Most notable gains were recorded in Italy (from 27% to 40%), Poland (26% to 36%) and Ireland (49% to 58%). This summer we will operate our largest ever schedule (almost 2,500 routes with over 3,000 daily flights), capitalising on traffic restoration, and multi-year growth deals negotiated by our New Route teams. Structural EU capacity reductions following numerous EU airline failures or fleet reductions during Covid, high oil prices (discouraging weaker, unhedged, airlines from adding capacity), a shortage of aircraft (new & leased) and the return of Asian and American visitors to Europe (due to the very strong US$) means that while S.23 European short-haul capacity remains below pre-Covid levels, demand is notably robust. Forward bookings and air fares currently into S.23 are strong and we continue to urge all customers to book early to avoid rising “close-in” prices.

“We expect European airlines will continue to consolidate over the next 2 years and it seems likely they will deploy capacity in a disciplined manner. The large backlog of OEM aircraft deliveries is likely to constrain capacity growth in Europe for at least 4 more years which confers a considerable growth premium on Ryanair’s remaining 110 B737 Gamechangers deliveries over the next 3 summers. Our widening unit cost advantage over all competitors, our fuel hedging, strong balance sheet and our very low-cost aircraft order book, as well as our proven operational resilience, creates enormous growth opportunities for Ryanair over the coming years...”

Ryanair Holdings, plc is Europe’s largest airline conglomerate and the parent company of Buzz, Lauda, Malta Air, and Ryanair DAC. The airline carries over 150 million passengers annually with more than 3,000 daily departures. Ryanair serves over 200 destinations in 40 countries with a fleet of 537 aircraft including Boeing 737NGs, Boeing 737-8200 Gamechangers and Airbus A320s with Lauda. The carrier plans on growing their fleet to 600+ aircraft by 2026. Ryanair has maintained a stellar safety record for nearly 40 years and prides itself on being “Europe’s greenest cleanest airline group,” promising customers a reduction in CO2 emissions of up to 50%, versus the “Big 4 EU major airlines.” The company continues to grow across Europe and plans on carrying 300 million passengers annually by FY 2034.

Source: Ryanair