American Airlines Reports First Quarter 2022 Net Loss of $1.64 Billion or $2.52 Per Diluted Share

- Joe Breitfeller

- Apr 21, 2022

- 2 min read

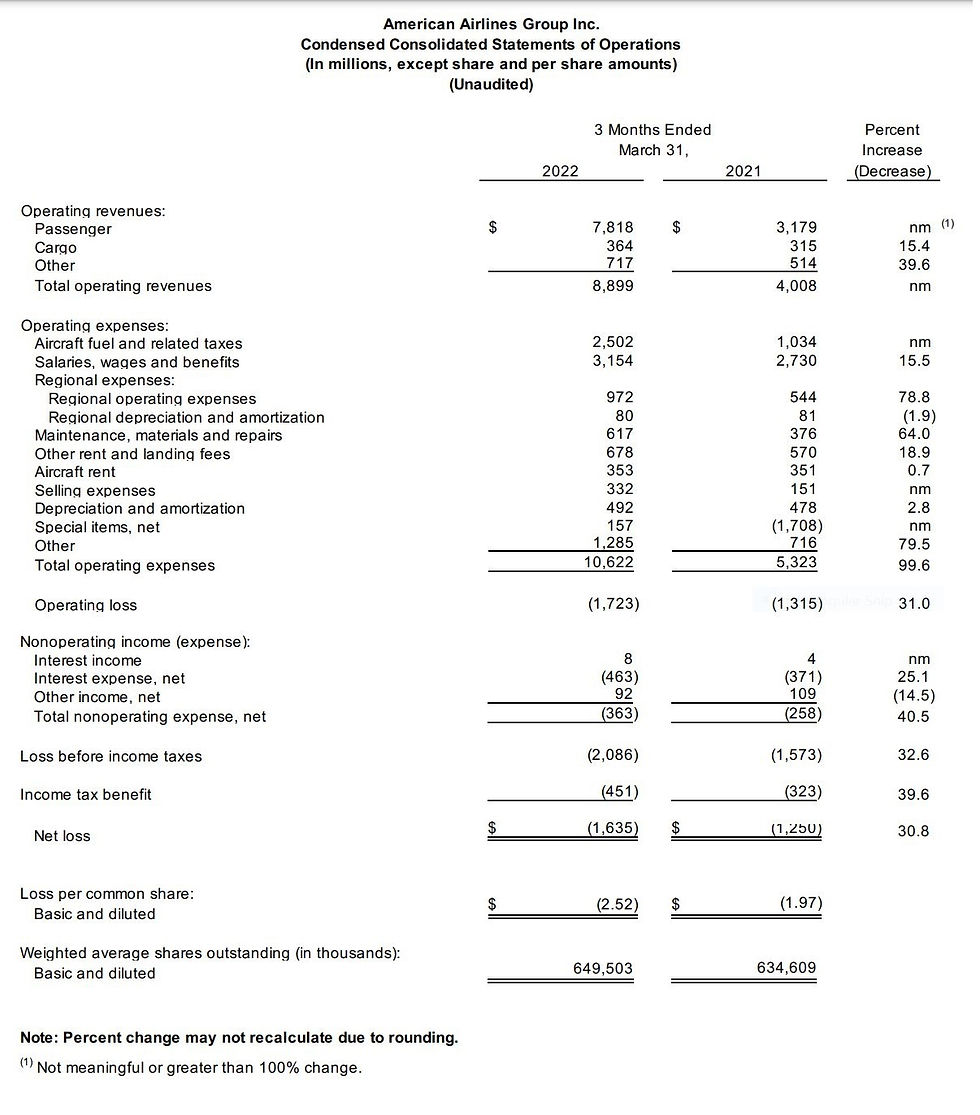

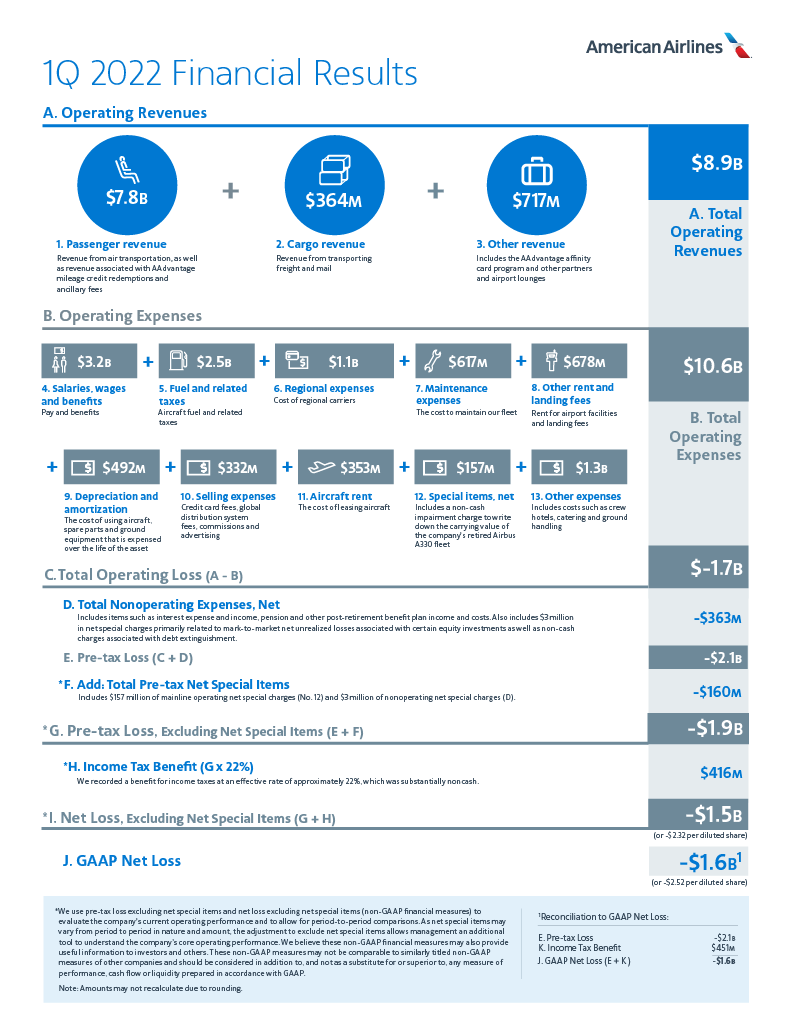

American Airlines has reported a first quarter 2022 net loss of $1.64 billion or ($2.52) per diluted share on a 16 percent decline in revenue versus 2019 to $8.9 billion. At March 31, 2022, the carrier had $15.5 billion in total available liquidity.

On Thursday (April 21, 2022), American Airlines reported their first quarter financial results for the period ending March 31, 2022. The airline reported a first quarter net loss of $1.64 billion or ($2.52) per diluted share on a 16 percent decline in revenue compared to Q1 2019 to $8.9 billion. American Airlines' Q1 total revenue per available seat mile (TRASM) increased year-over-year by 40.8 percent to 14.95 cents, while cost per available seat mile (CASM) increased 26.6 percent versus Q1 2021 to 17.84 cents. Excluding fuel and net special items (CASM-ex), the airline’s first quarter cost per available seat mile declined year-over-year by 18.7 percent to 13.38 cents. At March 31, 2022, American Airlines had $15.5 billion in total available liquidity.

In today’s announcement, American Airlines’ CEO, Robert Isom, said,

“Our priorities for this year are clear: Run a reliable operation and return to profitability. The outstanding progress we’ve made is only possible because of the amazing efforts of the American Airlines team and we’re optimistic about the continued recovery in the second quarter and beyond. The demand environment is very strong, and as a result, we expect to be profitable in the second quarter based on our current fuel price assumptions. The work we have accomplished over the past two years — simplifying our fleet, modernizing our facilities, fine-tuning our network, developing new partnerships, rolling out new tools for customers and team members, and hiring thousands of new team members — has us very well-positioned as the industry continues to rebound.”

American Airlines continues to execute on their plan to pay down approximately $15 billion in debt by the end of 2025. Since reaching peak debt levels in the second quarter of 2021, the carrier has reduced their overall debt by $4.1 billion. The company also has cost-effective financing in place for aircraft deliveries through the third quarter of 2022, and the airline is currently evaluating financing options for deliveries from the fourth quarter of 2022 through the first half of 2023.

American Airlines’ purpose is to “care for people on life’s journey.” Shares in the American Airlines Group, Inc., trade on NASDAQ under the ticker symbol AAL and the company’s stock is included in the S&P 500.

In trading Thursday morning (April 21, 2022), shares in American Airlines Group, Inc. (NASDAQ: AAL) were 6.24 percent higher at $20.70/share (11:45 AM EDT).

Source: American Airlines