Allegiant Travel Reports Third Quarter Net Loss of $29.1 Million on 54 Percent Revenue Decline

- Joe Breitfeller

- Oct 29, 2020

- 4 min read

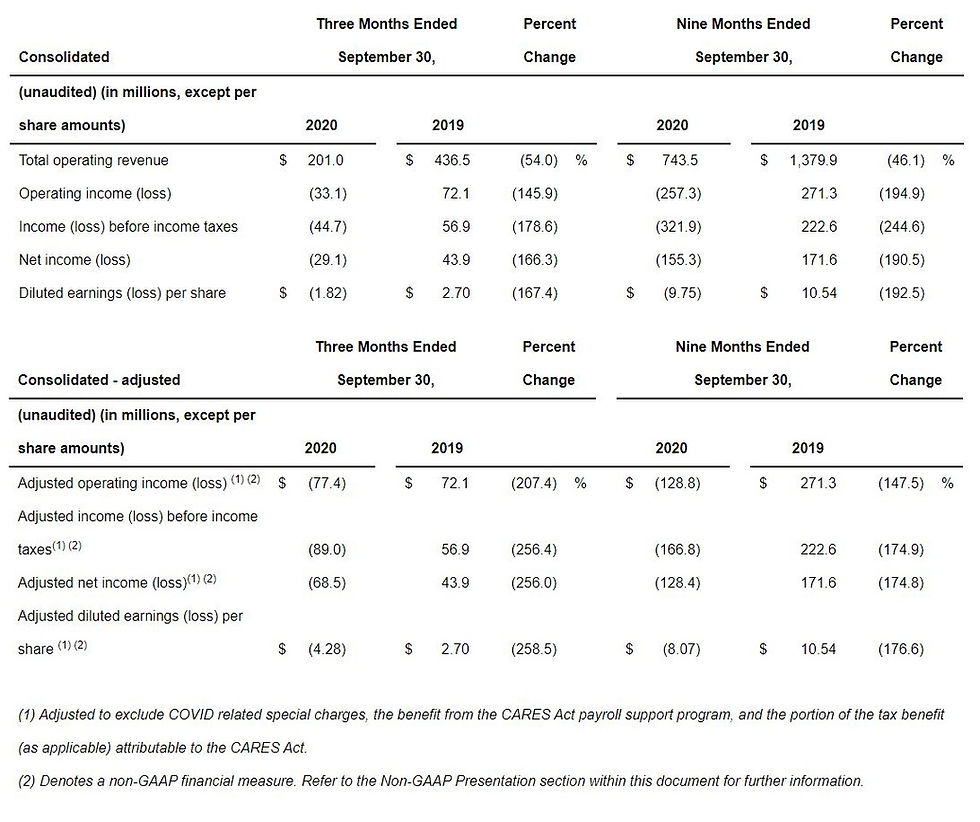

The airlines third quarter net loss was ($29.1) million or ($1.82) per fully diluted share and the company’s adjusted net loss was reported as ($68.5) million or ($4.28) per share. Year-over-year revenue declined 54 percent to $201 million.

On Wednesday (October 28, 2020), the Allegiant Travel Company reported their third quarter financial results with a net loss of ($29.1) million or ($1.82) per diluted share compared to net income of $43.9 million or $2.70 per diluted share during the third quarter of 2019. The airline’s Q3 adjusted net loss was ($68.5) million or ($4.28) per fully diluted share versus an adjusted net income of $43.9 million or $2.70 per share during the same period last year . In Wednesday’s announcement, Allegiant Travel Company’s Chairman and CEO, Maurice J. Gallagher, Jr., said,

“As we continue to navigate through the pandemic we have been encouraged by the modest, yet consistent improvements during the third quarter and into the fourth. Consumer confidence towards air travel is improving as seen in our quarterly performance. We completed the quarter beating consensus with a loss per share of $4.28, excluding one-time, special items, and the benefit from the CARES Act. Our scheduled capacity year-over-year was down less than seven percent, perhaps the best showing in the industry. Revenue is also trending in the right direction with September totals down 43 percent versus prior year. Although we still have a long road ahead of us, the progress we've seen is a direct reflection of the quality of our people and the nimbleness of the model.

"As we move into the fourth quarter, we remain focused on cash management. Our cash preservation strategy continues to center around maintaining a broad selling presence as well as stripping costs from the business. Our revenue and planning teams have done an exceptional job optimizing our schedule available for sale. We've seen average daily gross bookings increase from just over $2 million per day during the third quarter to over $3 million per day thus far in the fourth quarter. On the cost front, we successfully reduced variable operating expenses by nearly 30 percent, excluding the CARES Act payroll support benefit and one-time special items, which outpaces our reduction in capacity more than threefold. These savings are important in paving the way to cash break-even. Our cash preservation strategies coupled with strategic capital raises over the last several weeks have contributed to our pro forma cash balance of $850 million.

"Even though we're pleased with recent progress, we remain cautious. We have had to make tough decisions the past few months, including a reduction in our workforce. Although difficult, these steps were necessary to right size our organization to better align with demand. This environment has been difficult for our team members, and I cannot thank them enough for their continued hard work and dedication during this trying time. Their efforts to prioritize health and safety for our passengers, and our leadership efforts to bolster the financial health of the company have laid a solid foundation for our recovery. This has been and will continue to be a slow climb out of this abyss known as COVID. At this point, I believe we are leading the way out towards light ahead in the coming months and year."

Allegiant has reduced their management and support work groups by 25 percent or 300 positions, including voluntary leaves. The carrier also furloughed 100 pilots on October 1st and plans on furloughing an additional 30 pilots on November 1, 2020. The company reported a positive cash flow in September, excluding a $5 million payment connected with the termination of a loan agreement to finance the development of Sunseeker Resorts Charlotte Harbor in Florida. Year-over-year scheduled capacity for the quarter was reduced by 6.5 percent and the company’s load factor in September was 57.4 percent in September, the best result since March. Allegiant expects to operate with 15 percent reduced capacity during the fourth quarter compared to the same period last year.

During the third quarter, the carrier’s operating expenses were down 35.8 percent to $234.1 million. As of September 30, 2020, Allegiant Travel had cash, cash equivalents and short-term investments totaling $708.9 million. Allegiant’s average daily cash burn was $1.3 million in the third quarter and gross bookings averaged $2 million per day. At the close of the quarter, the airline had 22 unencumbered aircraft and four unencumbered spare engines. The company ended the quarter with an air traffic liability of $334 million including $116 million related to future scheduled flights and $218 millions in vouchers for future travel. Allegiant’s remaining 2020 CAPEX is approximately $130 million and includes five previously executed aircraft purchase agreements and around $10 million in deferred heavy maintenance. The carrier expects to operate 93 aircraft by the end of 2020, not including company owned aircraft which are currently being stored.

Founded in 1999, Allegiant links passengers from small to medium cities to world-class leisure destinations with all non-stop flights and industry-low average fares. The company offers base airfares that are often half the price of a typical roundtrip ticket and operates an all-Airbus A320 Family fleet. In after-hours trading Wednesday, shares in Allegiant Travel Company (NASDAQ: ALGT) were 6.34% lower at $123.90/share (5:36 PM ETD)

Source: Allegiant Travel Company